When users register on Buildern, we automatically apply the relevant tax (such as the sales tax, GST, or VAT) based on location. Customizing financial settings is essential to managing your business and will be used in all calculations associated with invoices, bills, payments, etc.

Currently, the automatic customization is only available for users located in Australia.

However, Buildern understands that tax regulations can vary, and businesses may need to customize their tax settings.

Let's head to your account's finance settings to get started.

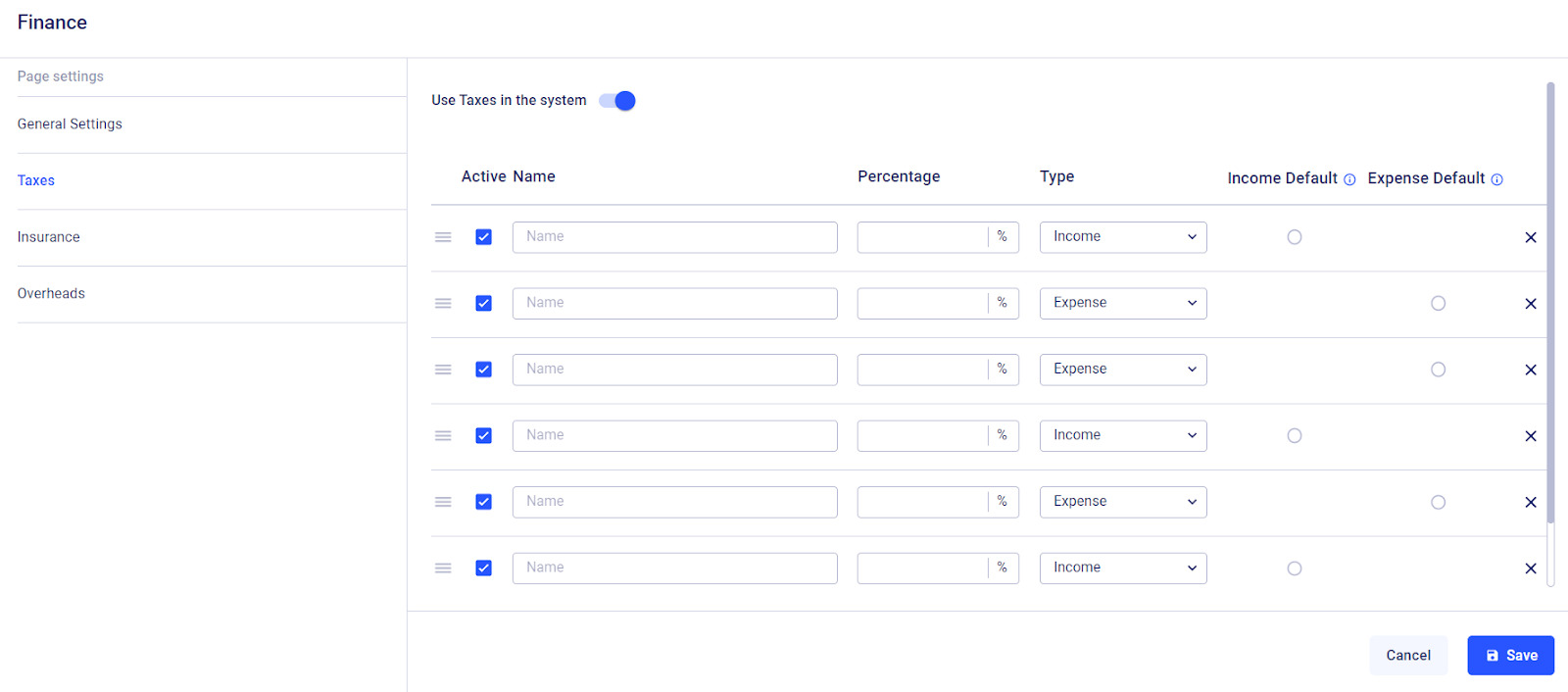

Go to the "Taxes" section to fill in the tax details, like name and percentage, and select whether it is an income or expense tax.

Click the "Save" button once everything is double-checked.

Buildern makes it easy to add and edit taxes for expenses and income. By following these simple steps, you can ensure that your financial settings are correctly configured to help you manage your construction projects effectively.

The system will apply these taxes to all invoices and payments sent or received through Buildern. So, you can rest assured that your financial settings are always up-to-date and accurate.

💡Best Practices for Tax Management in Buildern

1. Company Level Taxation Setup

Set up taxes at the company level to ensure consistency across all projects. Remember to update your tax settings if your business location or regulations change. Buildern will apply the changes to all current and future projects.

2. Integration with Accounting Software

Integrate Buildern's tax settings seamlessly with accounting software. This integration streamlines the transfer of tax-related data for financial analysis and reporting.

Whether you are using Xero or Quickbooks, Buildern’s two-way integration will ensure a cohesive and error-free flow of tax information across systems.

💡Recommended Reading

3. Setup Income Default and Expense Default Taxes

Configure Income Default and Expense Default taxes at the company level to save time on billing and invoicing. This means you do not have to add the same income or expense tax manually if you frequently use the same income or expense tax. Buildern will apply these settings automatically when you create a bill or invoice.